(co-written with Scott Gilbert, long-time consulting partner and PM thought leader)

(co-written with Scott Gilbert, long-time consulting partner and PM thought leader)

At most B2B SaaS companies, nobody is tracking customers across their entire revenue journey. As a result, these companies are leaking revenue at every step.

Most B2B companies are structured so that no single organization is responsible for the overall customer experience. Marketing and Sales bring in prospects; Product Development provides the “aha moment” within the product; then Service/Success teams show up at renewal time to upsell or convert customers. Each department runs a distinct set of operational analysis tools. This produces silos of customer data, breaking up the steps in a customer’s journey.

Lack of coordinated analytics makes it difficult to visualize and improve the end-to-end journey: drive conversion, create successful customers, boost renewals, glean strategic insights that improve marketing effectiveness, or prioritize new features. We’re missing the chance to learn from customer behavior — to create a virtuous cycle of customer success and improved revenue performance.

Comparatively, B2C companies are way ahead, successfully applying behavioral analytics to drive business outcomes and iterate service improvements. Any product manager at Amazon or Shutterfly or Schwab or DropBox should be able to tell you which user activities lead to repeat purchases/renewals, and which website changes have boosted usage metrics/revenue. In the B2C space the revenue and operational models tend to be more straightforward: either users are compelled to buy or not. In B2B, there are longer adoption cycles and more friction points to overcome. Our observation is that most B2B SaaS companies are years behind B2C in defining customer success and tuning customer experiences to drive revenue. Why? Le’s dig into three contributing factors:

- Organizational structures lead to data silos

- Lack of insight about product/service usage

- Lack of clarity about the business problems, questions and metrics

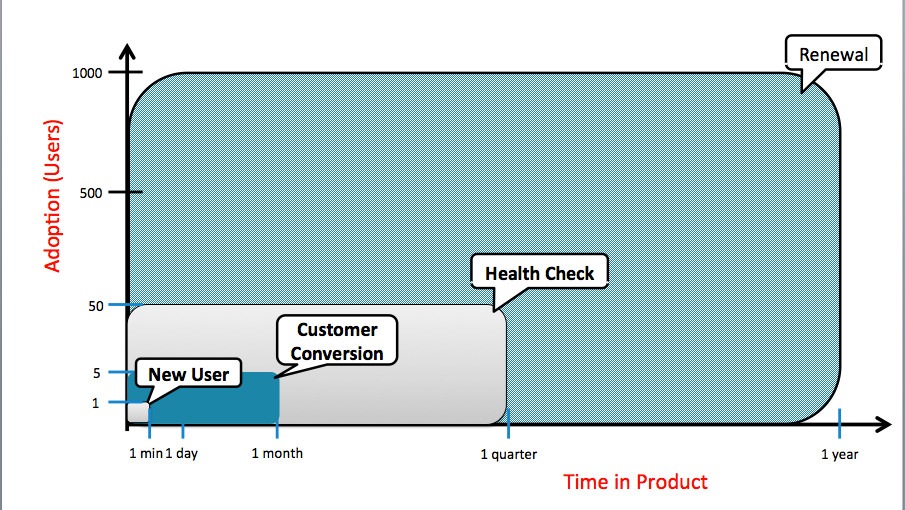

As a reference point for our conversation, this diagram lays out the major milestones that a customer goes through with a company using a “try before your buy” business model. Think cloud-based email marketing, project management or enterprise file sharing services.

The vendor uses heavy online advertising to attract and convince a few potential business users to try the service. Product and Support teams then try to convince a small pioneering team (say 5 users) to pay for the service. If things go well, the pioneers promote this out to a larger group of 25. Some months later, the vendor’s Service/Success team checks in to make sure our pioneers still like the offering. As the one-year license renewal period approaches, Inside Sales re-engages to push renewals and upsell from departmental to company-wide use.

1. Silos are Bad

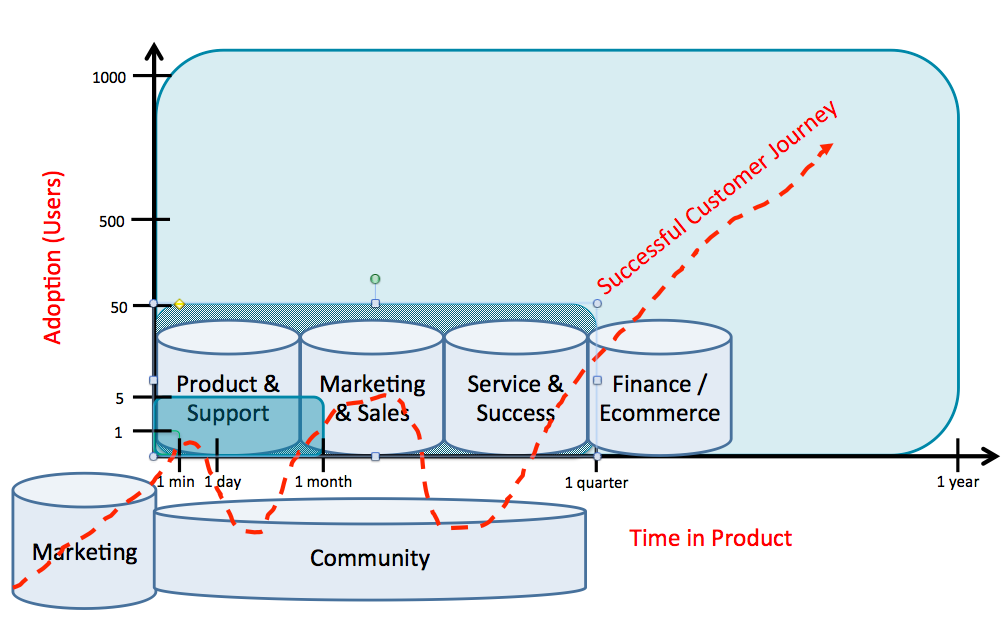

Typically, marketing/advertising data is siloed separately from production usage logs, which are siloed separately from pending renewal info. The picture below shows what this user/customer journey might look like from a corporate perspective:

Each department covers a part the journey, and each business system has a different data model – making it hard to correlate and analyze behavioral data broken into Marketing, Product, Community, Success, Sales and Finance systems.

2. Lots of Product Usage Data, Very Few Insights

Behavioral data is usually scarcest within the core product. Most B2B SaaS companies start by developing their product/service: investment companies build their own portfolio analysis apps; online financial providers write their own accounting software; online recruiting services hand-craft their resumé-matching software; shipping logistics companies bet their reputations on in-house package tracking.

And instrumenting these strategic internal applications to track detailed user activity is typically an after-thought. Requirements and development are focused on what the app should do, and the features that users need – not on instrumentation to track which features are used, what paths users take, or how these correlate with customer success. Interesting data is squirreled away in log files, or thrown away. Answering ad hoc questions about user behavior is nearly impossible.

3. No Shared Metrics and Clear Business Questions

Finally, departmental managers may not have a shared understanding or alignment around common business metrics. Marketing is paid to boost initial trial usage (not paid adoption or renewal), so focuses on consumer-style “cost per conversion.” Product Management worries about prioritizing new features. Support is rewarded for quickly resolving open tickets, even for confused solo users who are outside our target audience. Inside Sales is paid for renewals/upsells regardless of good user experience or product fit. Without a shared set of metrics and analytical tools, each group pursues its fragmented goals. (Part-time departmental “data wizard” present uncoordinated trends and beliefs.) It’s hard to ask the right global questions about customer success and segmentation.

One way to reduce confusion is to focus on one problem or opportunity at a time:

- Hypothesis – What do we think about…?

- Observations – What do we see regarding..?

- Actions – What do we do about…?

For example:

Hypotheses

- Are we clear about what defines customer/user success? How do we know who is succeeding?

- What are early indicators that a user is succeeding? How does this align with renewals?

- What are the predictors for renewals and upgrades? Are there segments (demographics, industries, etc.) that are more/less successful?

Observations

- What do our fall-off ratios look like? What portion of prospects drop out going from

- Website to Signup

- Signup to Key Actions

- Key Actions to Conversion

- Conversion to Success

- Success to Expansion/Renewal

- Who are the successful and unsuccessful users? How would we group them?

- Do successful users behave differently from least successful? How?

- Where are new users getting stuck? How do successful users get unstuck?

- What are our users actually doing within our application?

Actions

- Can we target feature/UI improvements to the most-used parts of the service? To the places folks get stuck/abandoned?

- Going back to the top of the marketing funnel, can we target groups/segments that will be more successful, not just more likely to try?

- Can we discourage users who want a related B2C service by posting links to free offering?

OK. How do I get started?

Understanding B2B user behavior calls for a mix of analytical insight, relentless execution and technical investment. A recipe for improvement would include:

- Some dedicated resources: A cross-functional team to drive toward a workable starting solution; a behavioral analyst who knows how to look for useful patterns and can read the results; some development cycles to instrument the core app put results in a big data repository and get a query facility running

- A focused set of hypotheses. However, since the answers about what success looks like will be hard to predict and may be slow to emerge, prepare to over instrument your products and collect the data rather than sequential experimentation. The longest lead time is in gathering valid data, not interpreting it.

- Patience, since this is an ongoing effort, not a one-week exercise. Executives may be looking for quick answers, but useful insights are pegged to the customer’s success timeline. If it takes a month for users to get familiar with app and two quarters to gauge renewal results, we need to plan for a similar analytic timeline.

The product management organization is probably best suited to drive toward solutions. Product managers reach across organizations, marshal resources, apply whole product thinking, and locate the ROI. They (should) know what customers should be doing, and can describe what success looks like. Consider putting your best PM on this, since she’s probably aching for a new challenge and a way to deliver measurable business improvements.

Sound Byte

We can gain a ton of insight into our customers’ pitfalls and successes if we harness behavioral data about the customer’s revenue journey. This is both a technical and organizational challenge for companies, since they typically optimize individual business functions instead of the entire system. Start by analyzing product usage and clearly defining customer success.