During a miserable week of domestic air travel during June, I noticed new fees suddenly appearing for checked baggage and in-flight soft drinks. That caused an announcement about a new airline to catch my eye – an airline offering a radically different approach to pricing. It re-raised a topic that we explore with many clients: shifting the basis of competition by changing pricing units.

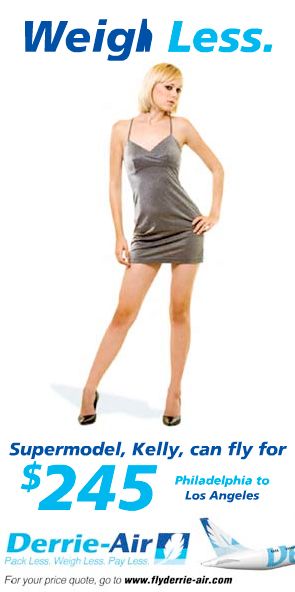

On June 6th, 2008, a new airline called Derrie-Air started advertising fares based on total passenger weight, with the slogan “Pack Less. Weigh Less. Pay Less.” A flight from Philadelphia to Los Angeles was priced at $2.25 per pound – with each passenger paying based on body weight plus luggage. Thus a supermodel carrying only a fashion tote could get to LaLaLand for $210 while Big Uncle Ralph and his steamer trunk would be $830.

This pricing model nicely aligns with an airline’s largest cost – jet fuel. It also offered some “green” opportunities to reduce carbon emissions. As you might have guessed, Derrie-Air turned out to be fictitious: a one-day advertising stunt by Gyro and the Philadelphia Inquirer to show that newspapers are still relevant. Still, it provided food for thought.

And Based On Some Good Theory

Enthiosys CEO Luke Hohmann, in Beyond Software Architecture: Creating and Sustaining Winning Solutions, writes extensively about what we call value exchange models. More than just price points, these address the fundamental models for trading something of value. The most obvious is a one-time hardware purchase, as in “I’ll give you $120 for that iPod.” But the more interesting options include service/subscription (“I’ll pay Rhapsody a monthly fee for all the music I can listen to”), transactional (“I’ll pay iTunes once for songs I can play forever”), sponsorship (“I’ll watch your 30-second advertisement in return for a free video download”), metered access (gift cards), time-based (free on weekends), etc.

In the software world, there’s tremendous room for experimentation. Our team has designed dozens of feature bundles, service and training offerings, one-time activation fees and upgrade pricing. More interesting are the units we use to define prices: numbers of subscribers (for email marketing services), CPU minutes (for cloud-based computing), peak MB/sec (for premium cable data offerings), tax years updates (for personal finance software). It can get dizzying.

So How Do We Cut Through The Clutter?

There are an infinite number of value exchange models. Modeling them all, or running huge conjoint analyses seems unreasonable. A good way to turn this around is via collaborative sessions with customers and prospects. (Enthiosys calls these Innovation Games®.) Naive and knowledgeable users are asked how they derive value from products (features), to finish this general statement:

“To get product/service X, I’d exchange Y units of Z”

The actual price ($7) is less interesting than the unit of value exchange (per month, per seat, per lawsuit, per condominium purchase, per hire). Sometimes, customers trade away intangibles such as time or attention or email addresses rather than hard cash. It would be great to align our exchange model with what the customer actually values.

And that’s where some disruptive pricing units may emerge. A new vendor can change the basis of competition by shifting to a new value exchange model. Are there customer segments that see value along a different dimension, and would drop their current vendor? And are these customers that we want?

For example, the CRM software-as-a-service market is built around per-seat-per-month pricing. If we wanted to attack the high end of this market, we might offer aggressive flat-rate corporate licenses – picking up companies with big monthly bills. Alternately, if we’re in the printing/postage business, we could offer the service for free but charge to print/send invoices and promotional mailings. Social networking players or data cleanliness experts could charge for keeping contact information constantly up-to-date, and discount the underlying CRM application. Remember that incumbents have trouble changing their value exchange models.

Back to Our Airline…

So having taken that quick tour through value exchange models, what would we expect from our mythical Derrie-Air? This sounds like a great new approach, but there are some problems to anticipate:

- Very few of us want to be weighed in public. Does Derrie-Air need check-in counters with privacy screens?

- They can’t price tickets in advance. Imagine not knowing what your flight will cost until you arrive. (I recently saw travelers stranded at the airport, unable to pay newly imposed per-checked-bag fees on their maxed-out credit cards.)

- If Derrie-Air succeeds in filling their planes with skinny travelers, they may fall short of revenue targets. “Seats” is still a limiting factor in planes, since everyone needs one.

- There are cheating opportunities. After check-in, perhaps I’ll buy that 10-volume encyclopedia at the airport bookstore…

And so on. New pricing units don’t solve all problems, and badly considered ones create a mess. There are financial/operational implications to innovative pricing models.

SoundByte

You may have an opportunity to disrupt entrenched competitors by adopting a new value exchange model – including new pricing units – and addressing an underserved segment. Find out how customers value your products, not just the amount they are willing to pay.